投資の神様と称される投資家ウォーレン・バフェット氏が会長兼CEOを務め、世界で最も有名な投資会社であるバークシャー・ハサウェイ社。

すごい投資会社なのだということは知っていても、保険事業が中核事業であることや、キャンディーを売っている会社だったりするなど、あまり知られていない部分も多い会社でもあります。

バークシャー・ハサウェイ社とはどのような会社なのか、この記事では押さえておきたいバークシャーのあらましについて解説していきます。

1、バークシャー・ハサウェイとは?

バークシャー・ハサウェイ社はネブラスカ州オマハに本社を置く、世界最大の持株会社。傘下には損害保険会社、鉄道会社、エネルギー会社など多くの子会社、関連会社を抱えるほか、投資会社として上場企業の株式を保有しています。

| バークシャー・ハサウェイ傘下の主な事業会社(2017年末時点) | |

| 保険事業 | GEICO(自動車保険会社) GeneralRe(再保険会社) Berkshire Hathaway Reinsurance Group(再保険)など |

| 鉄道事業 | BNSF(鉄道会社) |

| 公益・エネルギー事業 | Berkshire Hathaway Energy Company ・PacifiCorp(電力会社) |

| 製造業 | Fruit of the Loom Companies(下着メーカー) PrecisionCastparts (鋳鍛・締結・機構部品メーカー) ForestRiver (トレーラーメーカー) ShawIndustries (カーペットメーカー) |

| サービス・小売業 | McLaneCompany (卸売・配送) BerkshireHathawayAutomotive (自動車販売)TTI,Inc.(電子部品卸売)See’sCandies (チョコレート・製造・販売)など |

BERKSHIRE HATHAWAY INC. 2017 ANNUAL REPORT より作成

(1)バークシャー・ハサウェイの沿革

1960年代、紡績会社であったバークシャー・ハサウェイ社は、安価な外国製品などの台頭で工場は次々と閉鎖され、大規模なリストラが行われるなど破綻寸前の状態でした。

時価総額は工場などの保有資産の評価額を下回っており、本来の価値よりも割安な価格で取引されているとみたバフェット氏は、バークシャー株を購入します。

もともとは投資先のひとつであったはずが、旧経営陣との対立などを経て、最終的には敵対的買収という形でバークシャーの経営権を握ることとなります。

バークシャー・ハサウェイの経営権を握ったバフェット氏は、紡績業からの収益をもとに投資会社としての事業を拡大し、今や世界最大規模の投資会社にまで成長させたのです。

一方本業であった紡績事業からはその後も満足のいく収益は得られず、1985年に撤退しています。

のちにバフェット氏はこの買収を振り返り最大の失敗だったといい、「バークシャー・ハサウェイではなく、別の優良な会社に投資していれば、(その会社は今のバークシャーの)2倍の価値に成長していた」とも語っています。

一方、1970年代終わり頃から投資していた米国自動車保険大手の「GEICO(ガイコ)」は1996年に完全子会社化し、1998年に再保険会社General Re(ジェネラル・リ)、2007年にはオランダの損害保険会社NRGを買収するなど、保険事業は大きく拡大し、バークシャー・ハサウェイの中核事業となりました。

保険加入者が支払う保険料から保険金の支払いに充当するための準備金などを差し引いて残るお金(=フロート・float)は、実際に保険金の支払いが生じるまで繰り延べられる資金であり、ほとんどコストをかけず長期間運用に回せる資金の調達を可能にします。

このフロートが、バークシャーの投資事業を支える重要な原資となっています。

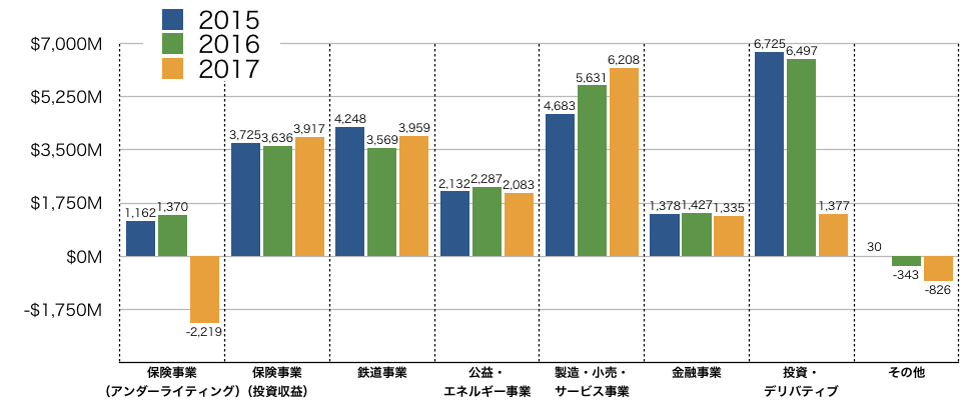

(2)各事業セグメントの収益

BERKSHIRE HATHAWAY INC. 2017 ANNUAL REPORT より作成

バークシャー・ハサウェイ社の各事業セグメントにおける収益額は、それぞれグラフに示した通りです。

上場企業への投資事業が注目されることが多いものの、傘下には世界的な企業を多く抱え、各セグメントでバランスよく収益を上げていることがわかります。

(3)A株とB株の違い

バークシャー・ハサウェイでは、バークシャーハサウェイ・A株とバークシャーハサウェイ・B株を発行しており、それぞれニューヨーク証券取引所(NYSE)に上場しています。

それぞれ以下のような違いがあります。

| 銘柄 | 株価(2018/11/2 終値) |

| バークシャーハサウェイ・A株(BRK.A) | $308,411.00 |

| 取引単価が高額であり、機関投資家など大口投資家が取引の主体。 A株株主は、好きなタイミングでA株1株をB株1,500株に交換可能。 | |

| |

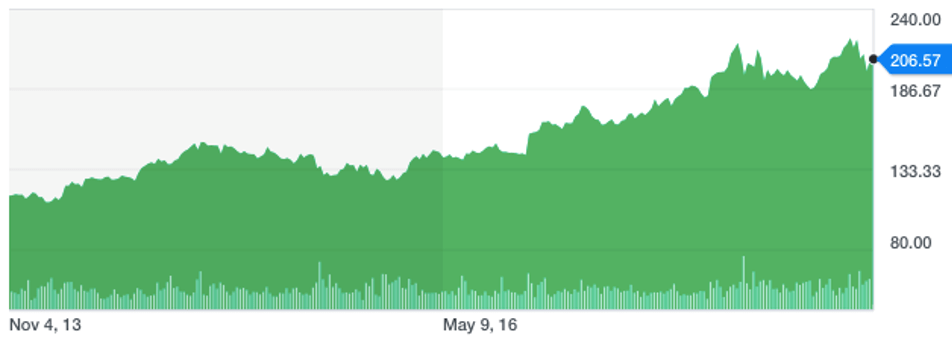

| バークシャーハサウェイ・B株(BRK.B) | $206.57 (B株理論株価<$205.60) |

| 取引単価が比較的少額であり、個人投資家が取引の主体。 B株株主は、B株1,500株をA株1株に交換不可。 B株の議決権はA株の1万分の1。 | |

| |

チャート:Yahoo Finance

現在A株は1株308,411米ドル(約3454万円・1ドル112円換算・2018/11/2時点)という超値嵩株であり、ほとんどの投資家には手が出せません。

そこで個人投資家にも投資しやすいミニ株的な存在がB株です。

A株とB株の交換比率は1:1500となっており、B株の理論株価はA株の1,500分の1となりますが、B株の議決権はA株の1万分の1に制限されていることを考慮すると、実際の価値はこれよりも小さくなると言えます。

バークシャー・ハサウェイの株価は機関投資家が主体となるA株主導で変動し、基本的にB株はA株に連動して動きます。

もしB株の株価がA株の1,500分の1を上回っていれば、A株を1株買うのと同時にB株1,500株を空売りすれば、ほぼノーリスクで利益を得られることになってしまいます。

このような状態は、裁定取引(アービトラージ)によってすぐさま解消されるというのが通説です。

しかし実際には、取引のしやすさなどからB株にプレミアムがついた価格で取引されるということが起こっています。

多少のプレミアムであれば許容されますが、B株の価格がA株の価格の1,500分の1を大きく上回っているような場合、B株が買われすぎていると考えられ、売買する際にはしばらく様子を見るなど注意が必要と言えます。

2、上場企業への投資

バークシャー・ハサウェイは投資会社として上場企業への投資を行っており、投資の神様と称されるウォーレン・バフェット氏がどのような企業に投資するのか、その動向には世界中の投資家が注目しています。

BERKSHIRE HATHAWAY INC. 2017 ANNUAL REPORT より作成

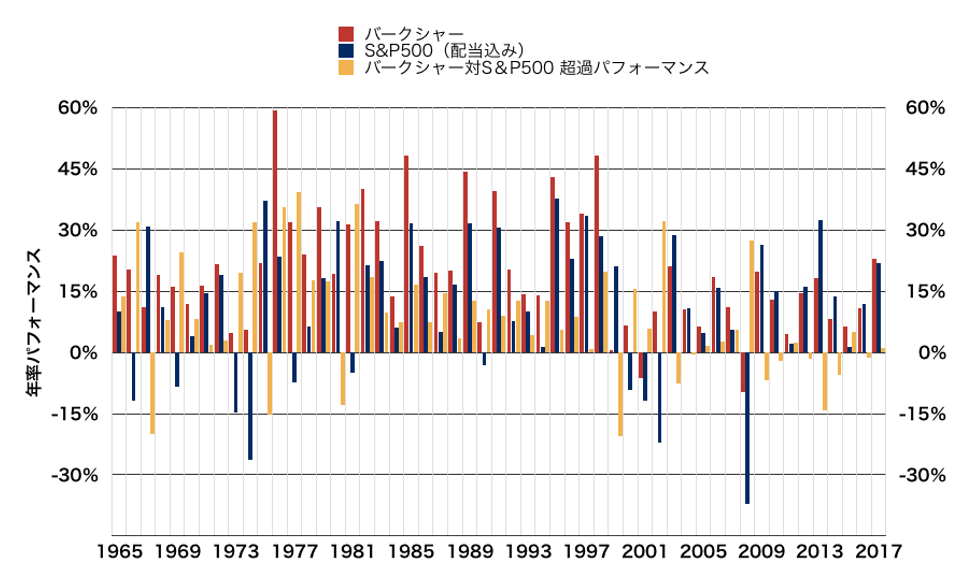

(1)パフォーマンスの推移

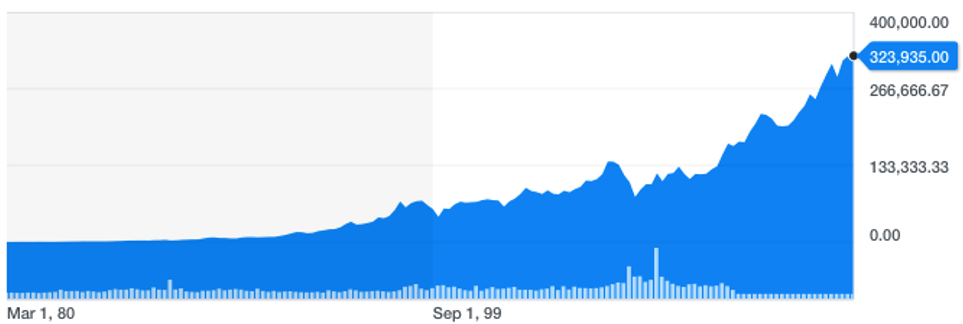

バフェット氏がバークシャーを買収したのは1965年から2017年まで、バークシャーの純資産(簿価)は平均年率19.1%(税引後BPS成長率)のペースで成長し、運用期間全体では約11,880倍となっています。

これは同期間のS&P500の平均年率9.9%(税引き前)、約155倍を遥かに上回る数字です。

年間でパフォーマンスがマイナスとなったのは2001年と2008年のわずか2回。その運用の安定性の高さには目を見張ります。

(2)現在の保有する銘柄

バフェット氏の投資手法は、キャッシュを生み出す力のある有望な企業に長期的なスタンスで投資するバリュー投資が基本となっています。

事業内容が明快、長期的に安定した成長が見込める、時代の変化に左右されにくいブランド力を持っているなどの条件を満たした企業を投資対象となります。

2018年6月末時点での保有銘柄上位10銘柄は以下の通りです。

| 保有銘柄上位10銘柄(2018年6月時点) | |||||

| 銘柄名 | ティッカー | ポートフォリオ内比率 | 平均取得 コスト | 株価 | 損益率 |

| アップル | AAPL | 23.84% | $141.66 | $204.20 | 44.15% |

| ウェルズ・ファーゴ | WFC | 12.81% | $48.31 | $53.61 | 10.98% |

| クラフト・ハインツ | KHC | 10.46% | $68.23 | $50.95 | -25.32% |

| バンク・オブ・アメリカ | BAC | 9.79% | $23.67 | $27.89 | 17.85% |

| コカ・コーラ | KO | 8.97% | $20.46 | $48.26 | 135.87% |

| アメリカン・エクスプレス | AXP | 7.60% | $100.67 | $103.71 | 3.02% |

| ユー・エス・バンコープ | USB | 2.57% | $47.46 | $52.07 | 9.71% |

| ムーディーズ | MCO | 2.15% | $178.20 | $149.46 | -16.13% |

| フィリップス66 | PSX | 1.99% | $74.04 | $99.01 | 33.73% |

| バンク・オブ・ニューヨーク・メロン | BK | 1.79% | $38.98 | $47.21 | 21.10% |

株価・損益率は2018年11月2日時点 出所:iBillionaire

(3)保有銘柄の変遷

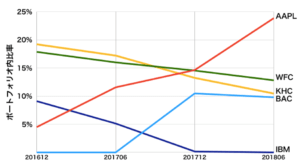

バフェット氏は長期投資を基本としていますが、状況の変化に応じて新規投資や買い増し、売却などが行われており、バークシャーのポートフォリオは変化しています。

その変化からはバークシャー、バフェット氏がどのような銘柄に期待しているのか、あるいは相対的な魅力が低下しているといったことを読み取ることができます。

以下のグラフは、直近ポートフォリオ内保有比率が5%以上大変動した銘柄の推移を示したものです。

| 銘柄 | 201612 | 201706 | 201712 | 201806 | |

| アップル | AAPL | 4.49% | 11.56% | 14.63% | 23.84% |

| ウェルズ・ファーゴ | WFC | 17.86% | 15.99% | 14.54% | 12.81% |

| クラフト・ハインツ | KHC | 19.21% | 17.20% | 13.24% | 10.46% |

| バンク・オブ・アメリカ | BAC | 0% | 0% | 10.48% | 9.79% |

| アイ・ビー・エム | IBM | 9.11% | 5.13% | 0.16% | 0% |

iBillionaireのデータをもとに作成

①アップル(AAPL)・アイ・ビー・エム(IBM)

このグラフで特に目に付くのは、やはりアップル(AAPL)の大量購入でしょう。

かつてはIT銘柄には投資しないことでも知られたバフェット氏ですが、IBMに始まり、近年ではIT銘柄にも積極的に投資を行っています。

アップルについては今年の5月には米CNBCのインタビューで「(アップル株を)100%を保有したい」と語るなど、アップルの持つ高いブランド力や収益性などを非常に高く評価していることがわかります。

最近では成長が鈍化傾向にあるアップルですが、収益構造をサービスへのシフトしたりや積極的な自社株買いの実施などで株価は着実に上昇しています

バフェット氏がアップルを買い増した2012年、2016年はいずれもPERが15倍を下回った時期です。

しかし今年に入ってからは、PER18倍のやや割高ともいえる水準でも買い増しています。このことから、バフェット氏はアップル株がまだまだ割安な水準にあると評価していると推察できます。

これと対象的なのがアイ・ビー・エム(IBM)です。

2017年10~12月期には約6年ぶりに増収に転じたものの、成長戦略がなかなか描けておらず、バークシャーは2017年中にほとんどの株を売却し、今年に入ってすべて株を売却しました。

②バンク・オブ・アメリカ(BAC)

昨年から大幅に保有数が増加したのが、バンク・オブ・アメリカ(BAC)です。

リーマンショックの影響で経営危機に瀕していたメリルリンチなどを買収したバンク・オブ・アメリカは、それが元で自らの経営状況が悪化してしまっていました。

2011年8月バンク・オブ・アメリカはバークシャー・ハサウェイに50億ドルの出資を仰ぎます。

その出資に際してバークシャーには6%の利回りが確定された優先株と一株当たり7.14ドルで7億株の株を取得できるワラントが賦与されています(行使期限2021年)。

2017年の保有数の増加は、FRB(米連邦準備制度理事会)にバンク・オブ・アメリカの資本計画が承認されたことを受け同社が大幅な増配、自社株買いに踏み切ったことから、優先株を普通株に転換したものです。

これによりバークシャーはバンク・オブ・アメリカの筆頭株主となっています。

③ウェルズ・ファーゴ(WFC)・クラフト・ハインツ(KHC)

ウェルズ・ファーゴ(WFC)、クラフト・ハインツ(KHC)は、ともにポートフォリオ上位を占める銘柄ですが、保有比率は減少傾向にあります。

このほかにもコカ・コーラ(KO)、プロクター・アンド・ギャンブル(PG)、ジョンソン・エンド・ジョンソン(JNJ)、ウォルマート(WMT)など、かつてポートフォリオの上位を占めていた銘柄の保有比率は大幅に低下しています。

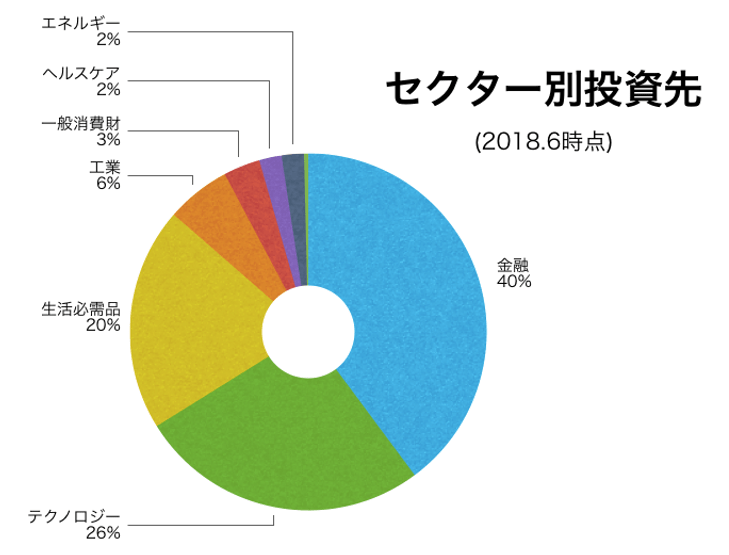

コカ・コーラやクラフト・ハインツなど、保有株数自体には大きな変化はないものの、株価の上昇が穏やかでポートフォリオに占める相対的な比率が低下している銘柄もありますが、ポートフォリオ全体傾向として、「生活必需品・消費財」から「金融やIT」へ比重が移ってきていると言えます。

3、バークシャーのポートフォリオを参考に投資する

50年以上にわたり、高いパフォーマンスを維持してきたバークシャー・ハサウェイ。

そのポートフォリオは私たちが投資銘柄を選ぶ際にも、大いに参考となるものです。

(1)バークシャーのポートフォリオを真似る投資

バークシャー・ハサウェイのポートフォリオと同じ銘柄でポートフォリオを組むという方法です。

バフェット氏が選び抜いた銘柄に便乗させてもらうものです。

この方法ではバークシャーがすでに投資した後に投資するため、すでに株価が上昇している可能性もあります。

とはいえバークシャーは長期的な視点で投資しているため、多少の遅れはそれほど心配はないと言えます。

ただしその銘柄をどのような経緯、どのくらいの価格で取得したのかはよく確認しなければなりません。

たとえば現在ポートフォリオ上位にあるバンク・オブ・アメリカ(BAC)やゴールドマン・サックス(GS)、これらの株はリーマンショックが発端となった経営難の際、バークシャーが出資を行い、破格の条件で取得したものです。

そのため、わたしたちが市場でこれらの株を買ったとしてもあまりメリットはないと言えます。

バークシャー・ハサウェイのポートフォリオを真似るのであれば、取得経緯や取得価格に注意しながら、業種(セクター)の比率を考えた上で、バフェット氏がポートフォリオとして適切とする、10銘柄程度を選ぶと良いでしょう。

iBillionaireのデータをもとに作成

■バフェット太郎の秘密のポートフォリオ(米国株配当再投資戦略)

バフェット氏の投資手法に学び、自ら実践しているバフェット太郎氏のブログでは、その投資哲学や自身のポートフォリオ、銘柄選定の方法などが公開されています。

全く同じ銘柄に投資するのではなく自分で銘柄を選び、バフェット流、バークシャー流のポートフォリオを構築したいという方にはとても参考になるブログです。

公式サイト:バフェット太郎の秘密のポートフォリオ(米国株配当再投資戦略)

(2)バークシャー・ハサウェイ株を買う

バークシャー・ハサウェイの運用成果による恩恵を受けたいのであれば、バークシャー・ハサウェイ株を買うという方法もあります。

バフェット氏自身がバークシャー・ハサウェイの筆頭株主であり、資産のほぼすべてがバークシャー・ハサウェイ株で占められており、彼は文字通り他の株主と一心同体となってバークシャーの経営、投資を行っています。

その目標は「バークシャー株の内在価値一株当たり平均年間収益率を最大限に高めること」であると述べており、その成果は、株価の上昇として株主に共有されるのです。

バークシャー・ハサウェイの株価には運用による成果のほか、事業会社の利益なども反映されるため、より大きなリターンも期待できます。

もしバフェット氏がバークシャー・ハサウェイを買収した1964年に、バークシャー株を100万円分買っていれば、2017年末には約240億4700万円(24,047倍)の価値になっています。

チャート:Yahoo Finance

まとめ

いかがでしたでしょうか。

バークシャー・ハサウェイ社は知れば知るほど、そのすごさが実感できます。

この記事をきっかけにより詳しくバフェット氏率いる、バークシャー・ハサウェイ社について知っていただければ幸いです。