投資の世界には、さまざまな運用方法があります。

今回は、その中でもハイリターンを目指すため、積極的な運用を行うアクティブ運用をご紹介します。

アクティブ運用やアクティブ型投資信託は、コストが高く、インデックス(市場平均)に勝てないのではないかとお考えの方も多いことでしょう。

果たして本当にそうなのか、アクティブ運用やアクティブ型投資信託を正しく理解するためのポイントを解説していきます。

1、アクティブ運用とは?

投資信託(ファンド)の運用スタイルには、「アクティブ運用」と「パッシブ運用」の2つがあります。

この運用スタイルを分ける基準となるのが「ベンチマーク」です。

このベンチマークとしては、TOPIXなどの指数(インデックス)がつかわれるのが一般的です。

アクティブ運用とは、このベンチマーク(市場平均)を上回る運用成果を積極的(アクティブ)に目指す運用スタイルのことを言います。

例えばTOPIXをベンチマークとするアクティブファンドであれば、ある一定期間にTOPIXが10%上昇したのであれば、その間に10%以上の運用成果を目指すことになります。

逆にその期間にTOPIXが10%下落しているのであれば、ファンドの運用成果がマイナスであっても、それが10%未満のマイナスに抑えられていればアクティブ運用だと言えます。

ちなみにパッシブ運用では、ベンチマークと同程度の運用成果を目標とする運用スタイルです。

例えばTOPIX構成銘柄を、その構成比率(各銘柄の時価総額の全体に占める割合)にあわせて組み入れたファンドを作れば、そのファンドの値動きはおおよそTOPIXに連動し、TOPIXをベンチマークとするパッシブファンドができます。

このようにパッシブファンドであれば組み入れる銘柄はベンチマークによって決まるため、組み入れる銘柄に関する調査や分析がほとんど必要ありません。

そのため調査や分析などの運用コストもほとんどかからず、パッシブ運用は一般的に手数料や運用報酬(信託報酬)が割安な傾向があります。

逆に、ベンチマークを上回る運用成果を目指すアクティブ運用では、組み入れる銘柄を選定するため、詳細な調査や分析を行う必要があり、手数料や運用報酬(信託報酬)が割高になる傾向があります。

2、主なベンチマークと投資対象は?

べンチマークは、そのファンドが投資対象とする商品の代表的な指数(インデックス)が用いられます。

| 投資対象 | 主なベンチマーク | |

| 日本株式 | TOPIX | |

| 日経平均株価 | ||

| JPX400 | ||

| 外国株式 | 米国株式 | S&P500指数 |

| NYダウ平均株価 | ||

| NASDAQ指数 | ||

| 先進国(日本を除く) | MSCIコクサイ・インデックス | |

| 先進国(日本を含む) | MSCIワールド・インデックス | |

| 新興国 | MSCIエマージング・インデックス | |

| 国内債券 | NOMURA-BPI | |

| 外国債券 | シティ世界国債インデックス | |

| REIT | 日本 | 東証REIT指数 |

| 先進国(日本を除く) | S&P先進国REITインデックス | |

| 国際商品(コモディティ) | ブルームバーグ商品指数 (Bloomberg Commodity Index) | |

3、アクティブ運用の投資手法

株式市場において他の投資家と同じような銘柄を買っていては、ベンチマークを上回る運用は難しいと言えます。

アクティブ運用では、ベンチマークを上回る運用成果をあげるために様々な投資手法が用いられます。

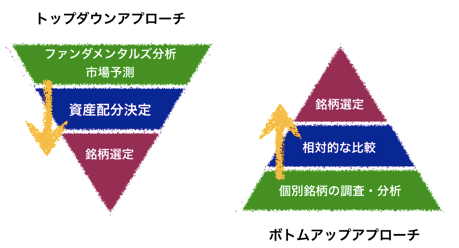

大きく分けて「トップダウンアプローチ」と「ボトムアップアプローチ」の2つがあります。

トップダウンアプローチは、まず国内外の成長率やインフレ率といったファンダメンタルズの分析をもとに、株価や金利、為替など市場予測を行います。

その予測をもとに、どの国の、どの資産に、どのくらいの割合で投資するかという大枠を決め、その枠内で具体的な銘柄・商品に絞り込んでいきます。

ボトムアップアプローチは、個別企業、商品を徹底的に調査・分析した結果をもとに、相対的にパフォーマンスの優れた銘柄・商品を選び出すという手法です。

ボトムアップアプローチではさらに、その銘柄の成長性を評価し投資する成長株(グロース株)投資と、本来の価値に対して株価が割安だと判断される銘柄に投資する割安株(バリュー株)投資があります。

実際には、トップダウンアプローチによる市場予測に基づいて資産配分の決定、ボトムアプローチによる個別銘柄・商品の選定というように、2つを組み合わせた手法もよく用いられます。

4、アクティブ型投資信託のメリット・デメリット

アクティブ運用を行うアクティブ型投資信託には、市場平均を上回る運用成果を目指すという特徴とともに、さまざまなメリット・デメリットがあります。

(1)アクティブ型投資信託のメリット

アクティブ型投資信託には以下のようなメリットがあります。

- 市場平均を上回る運用成果を期待できる

- 相場の下落時にも、資産を守るための機動的な運用が期待できる

アクティブ型投資信託では、ファンドマネージャーが市場平均を上回る運用成果を目指し、今後上昇しそうな銘柄を選ぶ投資を行います。

それだけでなく、相場が下落すると予想した場合には、現金比率を高めたり、リスクヘッジ商品を組み入れたりするなど、損失を最小限に抑え、資産を守るための対応をとります。

また、売建やデリバティブ取引などを用いて、下落相場においても積極的に収益を追求する、「絶対利益追求型」のアクティブ型投資信託もあります。

(2)アクティブ型投資信託のデメリット

アクティブ型投資信託にはメリットの反面、それに伴って以下のようなデメリットも生じます。

- 運用成果がファンドマネージャーの手腕に大きく左右される

- 運用コスト(手数料・信託報酬など)が割高な傾向がある

- 長期的に高い運用成果を維持することが難しい傾向がある

市場を上回る運用成果をあげるためには、ファンドマネージャーが多くの銘柄・商品の中から上昇していくものを見極め、適切なタイミングで投資できるかにかかっています。

そのためファンドマネージャーの手腕や、ファンドとしての運用方針に運用成果が大きく左右されやすいというところがデメリットだと言えます。

また、投資対象を選定するための調査や分析、さらに相場状況に応じてポートフォリオについて戦略を立てながら見直していくことが必要となるため、それにかかるコストは、パッシブ型投資信託に比べ多くなってしまいます。

その分のコストを私たちが手数料や信託報酬として負担することになります。

さらにアクティブ型投資信託には運用が長期になるにつれ、インデックスに近づいていく、あるいは下回ってしまう傾向があります。

これは、どんなに優秀なファンドマネージャーであっても、上昇期待の高い銘柄だけを選んで投資し続けることは至難のわざです。

多くの選択を繰り返すうちに結局は平均的な運用成果(インデックス)に落ち着いてしまうことが多く、もし途中で大きなミスをすれば平均をも下回ってしまうということです。

そのため、アクティブ型投資信託には信託期間(運用を行う期間)があらかじめ設定されており、長期運用を避け、一定期間で運用を終了する前提で設定されるものが多くなっています。

5、アクティブ運用よりパッシブ運用がいいの?

前述のように、アクティブ運用はコストが割高で、長期的にはパッシブ運用(インデックスファンド)に勝てないことも多いというデメリットがあります。

これを槍玉に挙げられ、「アクティブ運用はパッシブ運用に勝てない」「投資信託はコストの安いパッシブ運用(インデックスファンド)一択!」というような論調もあります。

アクティブ型投資信託には、インデックスを下回る運用成果しか出ておらず、運用コストも割高なファンドもあり、そのようなファンドに投資するのであれば、確かにインデックスファンドに投資しておくのが無難だとも言えるでしょう。

しかし、アクティブ型投資信託にはインデックスを大きく上回る運用成果を上げており、運用コストを差し引いてもはるかにメリットの大きいファンドも存在します。

つまりは、わたしたちの目的・ニーズにあった、メリットのあるファンドを選べばいいのであって、アクティブ運用のほうがいい、あるいはパッシブ運用ほうがいいと決められるものではありません。

日本株を対象とするアクティブ型投資信託の運用成績に関していえば、2012年12月〜2017年12月の5年間でTOPIX(配当込)が134%(*)上昇したのに対し、それを上回る成績を上げたファンドが半数以上も(413本中236本*)あります。

さらにTOPIXより100%以上高い運用成績を上げたファンドも47本(*)あります。

同時期にインデックスファンドに投資していても、アベノミクスなどによる相場環境に恵まれていたことから、それなりの成果は得られたでしょう。

しかし、その倍以上の大きな成果を得ることのできたアクティブ型投資信託があったのも事実です。

より高い運用成果を狙って投資を行うのであれば、アクティブ型投資信託を選択肢から外してしまうことは、自らチャンスを捨ててしまっているようなものです。

ただし、同時期にTOPIXを下回る運用成果のアクティブ型投資信託も約4割(413本中177本*)あることも無視できません。

「アクティブ型投資信託」に投資する際には、「どの」アクティブ型投資信託を選ぶか、そしてどのような買い方をするかも大切になります。

(*数値はザイ・オンラインを参照)

ここからはアクティブ型投資信託への投資で注意すべきポイントについてみていくことにしましょう。

6、2018年アクティブ型投資信託を買うときの注意点

2018年2月、それまで一本調子に上昇していた株式市場が急落しました。

楽観ムード漂う中での急落で、相場の見通しに不透明感が増しています。

ただ企業業績などは好調であり、さらなる上昇期待も依然残されています。

これが一時的な調整であるならば、これから投資を始める人にとっては絶好のタイミングとも言えます。

このような状況の中では、一旦様子をみるというのもひとつの選択です。

ここがチャンスとみて投資を行うのであれば、一度に資金の全額をつぎ込んでしまうのではなく、購入のタイミングずらして少しずつ買い増していくなど、買い方をよく考えた上で、慎重に行うようにしましょう。

またアクティブ型投資信託を選ぶ際には、過去5年(あるいは3年)のトータルリターンや純資産額(目安として50億円以上)、信託報酬などを同じ投資対象のファンドと比較することがポイントとなります。

7、おすすめアクティブファンド3選

最後に、アクティブファンドの中から、過去5年間における実績があり、今後も好成績が期待できるアクティブファンドを3本ご紹介します

| ひふみプラス(レオス・キャピタルワークス) | |||

| 基準価額 | 過去5年トータルリターン (年率) | 信託報酬 (税込/年) | 純資産額 |

| 40,865円 | +25.34% | 1.0584% | 5,553億円 |

| 国内外の上場株式を投資対象として、企業価値に対して株価が割安だと判断される銘柄に長期投資を行うファンドです。 銘柄選定は、長期的な産業のトレンドなど一部トップダウンアプローチを取り入れつつ、定性・定量の両面からの徹底的な調査に基づいたボトムアップアプローチ(バリュー株投資)により行われます。 割安だと判断できる銘柄がなくなってきた場合、買付を行わず現金比率を高めるなど相場状況に応じて柔軟な対応が積極的に取られることも特徴です。 | |||

| 組入上位10銘柄(2018年2月末) | |||

| MICROSOFT CORP | 1.8% | SG HD | 1.5% |

| パナソニック | 1.7% | 三菱商事 | 1.5% |

| 三井物産 | 1.7% | コスモス薬品 | 1.4% |

| ソニー | 1.5% | 光通信 | 1.4% |

| 東京センチュリー | 1.5% | 住友金属鉱山 | 1.4% |

| 新成長株ファンド・グローイング・カバーズ(明治安田アセットマネジメント) | |||

| 基準価額 | 過去5年トータルリターン (年率) | 信託報酬 (税込/年) | 純資産額 |

| 33,148円 | +34.52% | 1.836% | 541億円 |

| 本来高い成長力を持ちながら経営上の課題や困難によって実力を発揮できていなかった企業の中で、これらの課題・困難を克服しつつある企業を「新成長株(再成長銘柄)」と定義し、これらの銘柄に集中投資するファンドです(対象は日本株)。 銘柄選定は、成長株に特化したスペシャリストによる徹底的な調査に基づいたボトムアップアプローチにより行われます。 | |||

| 組入上位10銘柄(2018年2月末) | |||

| レック | 3.33% | レーザーテック | 2.72% |

| 日特エンジニアリング | 3.08% | 船井総研 HD | 2.59% |

| 物語コーポレーション | 3.04% | ジャパンマテリアル | 2.58% |

| アイスタイル | 3.03% | アークランドサービス HD | 2.56% |

| デクセリアルズ | 2.88% | 寿スピリッツ | 2.52% |

| DIAM国内株オープン・自由演技(アセットマネジメントOne) | |||

| 基準価額 | 過去5年トータルリターン (年率) | 信託報酬 (税込/年) | 純資産額 |

| 22,146円 | +25.16% | 1.728% | 261億円 |

| マクロの投資環境の変化に応じて、その時々で最適だと判断した投資スタイルで運用されるファンドです。基本的はトップダウンアプローチですが、固定的な運用スタイルには囚われず、状況に応じて自由な投資が行われます。 | |||

| 組入上位10銘柄(2018年2月末) | |||

| トヨタ自動車 | 2.48% | ソフトバンクグループ | 1.35% |

| 三菱UFJ FG | 2.29% | 東京海上 HD | 1.32% |

| 三井住友 FG | 1.16% | 花王 | 1.20% |

| ソニー | 1.49% | SRA HD | 1.14% |

| 日本電信電話 | 1.48% | オリックス | 1.09% |

(組入上位銘柄を除き、2018年3月20日時点)

*トータルリターンは分配金を再投資した場合の総合収益

*同期間TOPIXの過去5年トータルリターンは(年率)14.9%(参考:my INDEX)

まとめ

いかがでしたでしょうか。

アクティブ運用は、長期的にはパッシブ(インデックス)運用に勝てないとも言われます。

しかし、相場全体の低迷から資産を積極的に「守る」運用、そして相場環境に負けない運用を期待できるのもアクティブ運用の魅力です。

投資には様々な手法があり、どれが正解ということはありません。

大切なのは目的やニーズに合わせた手法を選ぶことです。

アクティブ運用(ファンド)も投資の可能性を広げるための選択肢として活用していきましょう。