2018年2月株価急落時に、VIX指数に関連するETFが大暴落したというニュースがありました。

株式投資をしている方ならご存知の方も多いのではないでしょうか。

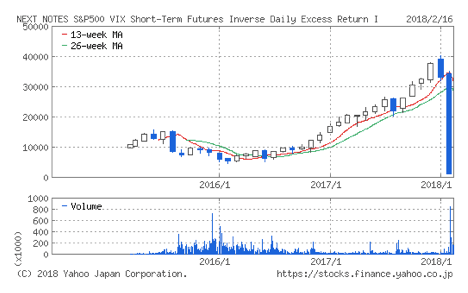

このときにはVIX指数の急上昇によって、VIX指数先物と反対の値動きをするVIXベアETF(・ETN)が大暴落し、「NEXT NOTES S&P500 VIX インバースETN(2049)」(2018/2/21償還)はたった1日で96%下落し、強制償還という事態になりました。

Yahoo Finance NEXT NOTES S&P500 VIX インバースETN

VIX指数は「恐怖指数」とも言い、その名前からして怖そうなイメージを持たれる方も多いのではないでしょうか。

実際に上記のVIXベアETNのようなこともあり、VIX指数をよく理解しないまま手を出せば大きなリスクを伴います。

しかしVIX指数について正しく理解することができれば、相場の大きな変動を利益に変えることも可能です。

この記事では、VIX指数の基本とVIX指数関連商品への投資とはどのようなものなのかを中心に解説していきます。

1、VIX指数とは?

VIX指数(恐怖指数)とは簡単に言えば、リーマンショックのようなことが起こり、投資家が相場の先行きに対する不安が大きくなり、動揺してパニックになると数値の上がる指数です。

正式にはVolatility Index(ボラティリティ・インデックス)と言い、アメリカのシカゴ・オプション取引所(CBOE)が、アメリカの代表的な株価指数であるS&P500を対象としたオプションのプレミアムの値動きをもとに算出し、公表しています。

ここでオプションを簡単に説明しますと、将来のある時点にある商品を今決めた価格で売買する権利のことで、その権利を買うために必要なお金がプレミアムです。

将来$100である商品を買えるオプションを$5のプレミアムで買い、約束の時点で商品の価格が$120になっていても、権利を使えば$100で商品を買うことができ、差額分$15の利益が得られる仕組みです。

価格がプレミアム以上に上がらなければ利益が出ないので、その商品の価格があまり上がらない(変動しない)と思う投資家が多いときにはプレミアムは小さくなり、逆に大きく上がる(変動する)と思う投資家が多いときにはプレミアムは大きくなります。

この価格変動幅をボラティリティと言い、ボラティリティが大きくなればプレミアムも大きくなるという関係があります。

投資家が相場の先行きに対する不安が大きくなり、動揺してパニックになると相場は乱高下し、それに伴うボラティリティも拡大します。

つまりVIX指数とは、相場のボラティリティに連動するプレミアムの値動きを、投資家の不安・恐怖度合いとして指数化したものです。

2、VIX指数の特徴は?リスクヘッジになるのか?

(1)VIX指数の特徴

VIX指数は相場のボラティリティが大きくなる、つまり相場が荒れると数値が大きくなるという特徴があります。

株価との関係では、株価急落時にはVIX指数は上昇し、相場が落ち着き、株価が上昇に転じればVIX指数は低下するという逆相関の関係がみられます。

「不安定な相場状況(≒株価急落時)=VIX指数上昇」

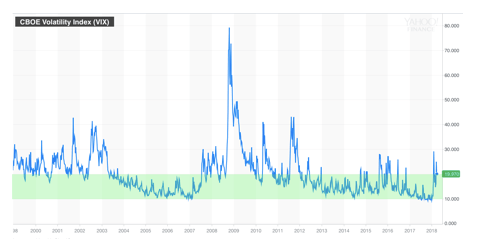

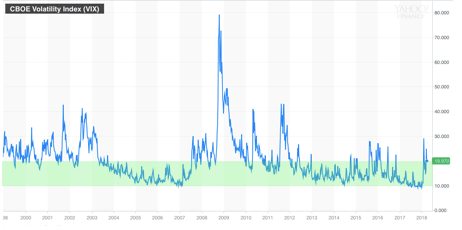

VIX指数は、平常時であれば10〜20の間を推移していますが、リーマンショックやブレクジットのようなリスクイベントが起こると、VIX指数の上昇が起こります。

しかしそのまま高止まりするということはなく、いずれ平常時の水準に戻るという特徴があります。

この特徴はVIX指数を理解する上で、重要なポイントとなります。

「恐怖はいつまでも続かない=VIX指数はいずれ平常時の水準に戻る」

Yahoo Finance CBOE Volatility Index

(2)リスクヘッジとしてのVIX指数

株価急落時には価格が上昇するという特徴があり、株価と逆相関関係のあるVIX指数は、リスクヘッジ商品として利用することもできます。

VIX指数自体は商品ではなく直接購入することはできないため、実際にはVIX指数を対象とした先物やオプション、その先物・オプション価格に連動するETF(・ETN)などの商品を購入することになります。

株価急落時には、これらの商品の価格上昇によって、その他の資産の下落リスクをヘッジすることができます(2018年2月6日の株価急落時には、VIX短期先物指数ETF(1552)はストップ高をつけています)。

VIX指数連動型ETF(・ETN)は、わたしたちが最も利用しやすい商品と言えますが、その仕組みから価格が下がり続けるという宿命があり、保有し続けることで資金が目減り(減価と言います)してしまうため長期保有には向きません。

そのため全くの突発的なリスクに備えてずっと保有しておくというよりは、リスクイベントが近づいている、あるいはリスクがくすぶっているような状況に備えるという目的で、買いポジションのリスクヘッジとして短期的に保有することが基本となります。

実際にVIX指数連動型ETF(・ETN)のチャートをみてみると、どれも見事な右肩下がりとなっています。

Yahoo Finance iPath S&P 500 VIX ST Futures ETN (VXX)

Yahoo Finance 国際・VIX短期先物指数(1552)

3、VIX指数関連商品へ投資する方法

(1)VIX指数関連商品

指数であって直接投資できないVIX指数へ投資するには、VIX指数をもとに作られた「VIX指数関連商品」に投資することになります。

わたしたちが投資できるVIX指数関連商品としては、以下のようなものがあります。

| 銘柄名 | 連動指数 | |

| ETF | 国際 VIX短期先物指数(1552) | S&P500 VIX短期先物指数 |

| 国際 VIX中期先物指数(1561) | S&P500 VIX中期先物指数 | |

| CFD | 米国VI | VIX先物(CBOE) |

| 米国VIブルETF | プロシェアーズ・ウルトラ・VIX短期先物ETF(UVXY) (S&P500 VIX短期先物指数の日次変動率の1.5倍に連動を目指す) | |

| 米国VIベアETF | プロシェアーズ・ショート・VIX短期先物ETF(SVXY) (S&P500 VIX短期先物指数の日次変動率のマイナス1.5倍に連動を目指す) |

VIX短期先物ETF(1552)、VIX中期先物ETF(1561)については、証券口座があれば株と同じようにすぐに購入することができます(売り建てには信用口座が必要)。

「米国VI」などVIX指数関連商品を取り扱っている証券会社はGMO証券で、購入するにはGMO証券に口座でCFD(*)口座を開設する必要があります。

*CFDとは差金決済取引のことで、FXもこの一種(投資対象が為替のCFD)です。

(2)VIX指数ショート投資

VIX指数関連を買い、リスクヘッジ商品として利用する方法もありますが、積極的に利益を狙いにいくのであれば、VIX指数をショートする(売る)という投資法が有効です。

VIX短期先物指数ETF(1552)や米国VIブルETFのように、VIX指数と同じ方向の値動きをする商品では「売り」、米国VIベアETFのようにVIX指数と反対の方向の値動きをする商品では「買い」からスタートします。

①安定相場における長期投資

VIX指数連動型ETFは、相場が落ち着いているときには価格が下がり続ける「減価」という特徴を持っています。

VIX指数が10〜20のレンジで推移する比較的安定した相場状況では、この減価により、VIX指数連動型ETFを売建(米国VIベアETFでは買建)しておけば利益を出すことができます。

しかし、リスクイベントや株価の急落などが起こればVIX指数は急騰し、大きな損失を被るリスクもあります。

今年2月の株価急落はそれが現実となった事例ですが、実はVIX指数ショート投資自体が、その引き金のひとつとも言われています。

この方法は、さらに信用取引やレバレッジの絡む取引であることから損失が拡大するリスクも大きく、そのリスクを認識した上で投資する際には資金管理、リスク管理については特に注意しなければなりません。

②相場暴落時おける短期投資

VIX指数は相場暴落時には急上昇しても、いずれ元の水準に戻るという特徴があります。

そこで、VIX指数が急上昇したところでVIX指数連動型ETFを売建(米国VIベアETFでは買建)し、VIX指数が元の水準に戻ったときに買い戻すことで利益を出すことができます。

長期投資に比べて短期間で買い戻すため、VIX指数の急変に巻き込まれるリスクは軽減されます。

問題は、VIX指数がどこまで上昇するかわからないため、売建した後、さらにVIX指数が上昇してしまうと損失が出てしまいます。

そこで有効なのが、VIX指数が一定の値で上昇するごとに少しずつ売建ていく方法です。

いわゆるナンピンですが、VIX指数はいずれ元の水準に戻ることがわかっているので、リスクを軽減効果がより高くなります。

ただ、投資するのはVIX指数自体ではなくVIX指数連動商品のため、VIX指数の急変に巻き込まれ強制償還されるといったリスクは残ります。

またVIX指数の上昇が、リーマンショックのような「金融危機」が原因である場合、金融市場への影響が長引き、VIX指数が異常な値まで上昇したり、上昇が長期間続き元の水準に戻るにも時間がかかる可能性が高く、慎重に投資する必要があります。

そのほか、ブラックマンデーや2018年2月の株価急落(VIXショックとも)といった、原因が曖昧な状況でVIX指数が上昇した場合にも、慎重になる必要があります。

逆に、北朝鮮問題やテロなどの「地政学リスク」や大統領選などの「政治リスク」、地震やハリケーンなど「自然災害」などが原因の場合には、金融市場への影響がそれほど長引かない傾向があります。

このような場合には、積極的に投資しても良いと言えるでしょう。

| 発生月 | 原因 | VIX指数最高値 |

| 1997/10 | アジア通貨危機 | 38.2 |

| 1998/8 | ロシア通貨危機 | 45.7 |

| 2001/9 | アメリカ同時多発テロ | 43.7 |

| 2002/7 | エンロン不正会計事件 | 45.1 |

| 2008/9 | リーマン・ブラザーズ破綻 | 42.2 |

| 2008/10 | リーマンショック後の世界金融危機 | 89.53 *過去最高値 |

| 2011/3 | 東日本大震災 | 22.8 |

| 2011/10 | ギリシャ危機 | 46.9 |

| 2015/8 | チャイナショック | 40.0 |

| 2016/6 | ブレクジット(英国EU離脱決定) | 24.9 |

| 2016/11 | アメリカ大統領選・トランプ氏勝利 | 21.3 |

| 2018/2 | VIXショック | 50.3 *変動幅は過去最高 |

4、2018年のVIX指数!これからどう行動すればいい?リアルチャートをチェック

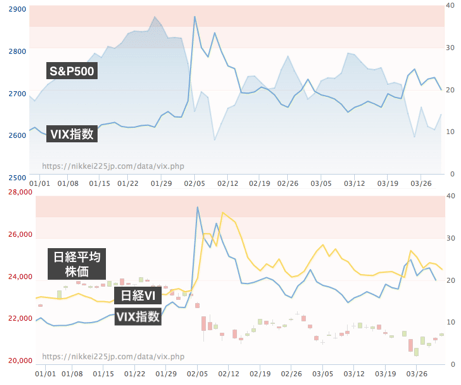

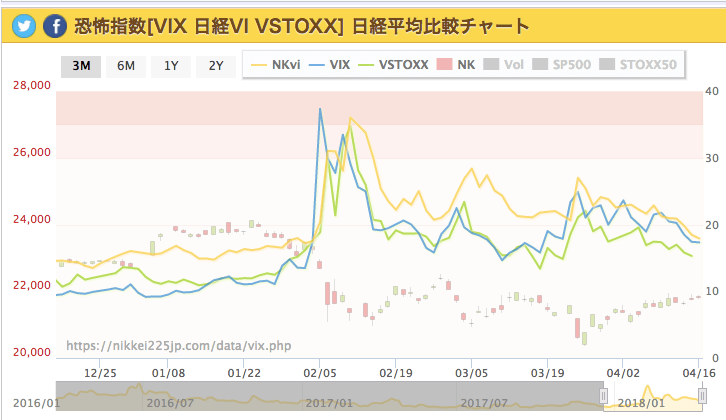

2018年のVIX指数は、1月には昨年から続いた長期上昇相場を引き継ぎ10〜20の間で安定して推移していましたが、2月に入ってからは状況が一変しています。

VIX指数は一時的に50を記録し、その後も20を度々超える状況が続いています。

恐怖指数[VIX 日経VI VSTOXX] 日経平均比較チャート

今回の株価急落・VIX指数急騰は長期間にわたる相場上昇が加速したことによる警戒感や、FRB利上げ、米中貿易戦争懸念などが重なり、VIX指数ショートポジションのロスカット連鎖的に拡大していったとも考えられています。

VIXショックとリーマンショックには、VIXショートとサブプライムローン債券という値動きの激しい(ハイボラティリティ)商品の信用取引の拡大とクラッシュという点では共通している部分があります。

リーマンショックでは、NY相場は約半年間下げ、その後元の水準に戻るまでに約2年を要しました。

しかし2009年に底を打ってから現在までにNYダウ平均株価は約3.5倍に上昇しています。

Yahoo Finance CBOE Volatility Index

では、今回はどうなってしまうのか。

現在の相場は、経済のファンダメンタルズからみれば悲観的なりすぎているようにみえます。

そのため投資家心理が回復すれば反発し、中長期的には再び上昇相場が続く可能性が高いと言えます。

しかし、米中貿易戦争懸念や米国株を牽引してきたFAANG(Facebook・Apple・Amazon・Netflix・Google)に陰りがみえ始めるなど、不安要素は残っています。

さらに日本株は米国株に比べても戻りが鈍く、安倍政権の支持率急落などの不安要素も抱えています。

ここ数ヶ月は、引き続き警戒が必要な状況です。

しっかりと銘柄を見極めた上で、優良株を仕込んでおく絶好のチャンスでもあります。

現状に悲観的になりすぎることなく、先を見据えて行動することが、長い目で見て利益を生むことになります。

VIX指数については、引き続き動向を注視していきましょう。

まとめ

いかかでしたでしょうか。

VIX指数にはいずれ、平常時の水準に戻るという特徴があります。

それは、恐怖はいつまでも続かない、下落の後には反発があるということであり、現状に悲観的になりすぎることなく、先を見据えて行動することの大切さを示しています。

しかし、それは恐怖を忘れてしまって良いということではありません。

相場では、恐怖に慣れ、忘れ、再び暴落するということを過去何度も繰り返しており、おそらくこれからもそれは続いていくでしょう。

相場を過度に怖がる必要はありませんが、安心しきっているときほど相場暴落時の損失は大きくなりがちです。

今回の急落は、適度な緊張感を常に持つことの大切さを教えてくれていると言えます。

適度な緊張感を持ち、相場暴落時にも冷静に対処できるようにするため、投資家心理が今どのような状態にあるかを確認するツールとして、VIX指数を活用していきましょう。